Friday, February 08, 2013

Hamden Tackles Pension Crisis

By Michael Bellmore

mbellmore@nhregister.com / Twitter:@bandango

HAMDEN — Hundreds showed up at the Miller Library Thursday night for a special meeting of the Legislative Council to hear the fate of Hamden’s pension fund.

A presentation was given by SEGAL, a consulting company, detailing its recommendations to help keep the pension fund solvent.

According to the presentation, Hamden has roughly $56 million in its pension fund. If it were fully funded, it would have more than $400 million invested for pensioners and current town employees.

“If you don’t do anything, in five years or sooner, the pension fund is completely bankrupt and the town goes to pay-as-you-go to pay its benefits.

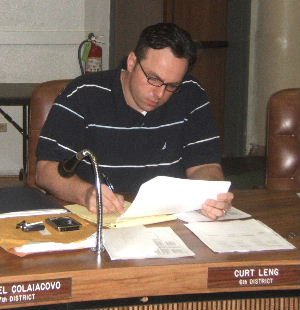

“If we went to a pay-as-you-go, and actually paid it, it means tax increase upon tax increase for every year, for the next 30 years,” said Curt Leng, chief administrative officer.

“If we do nothing and just pay our arc, next year we have to pay $28 million. So, essentially, what that equals in cash and mill rate, that would be a four mill increase in one year. The plan that was presented, if all the pieces can be negotiated properly, is a four mill increase over a six year period.”

Leng said the town’s goal is to achieve financial stability in a fair way while minimizing the impact on taxpayers.

Mayor Scott Jackson said the bottom line of this presentation is that the town, for the first time, has received qualified information on how to resolve the pension crisis.

“There needs to be an influx of cash, there needs to be long-term financial discipline, and there needs to be a hard look at the benefits people are earning today and forward,” Jackson said.

The long-term financial discipline Jackson refers to could be delivered by the town accepting a pension obligation bond from the state. This would bring $115 million to the town for debt servicing, but would also lock the town into paying the contributions it must pay in future budgets to solve the pension crisis.

But this is just one piece of the puzzle.

Leng said, “In order to achieve long-term solvency without dramatic tax increases or draconian benefit cuts, we would have to have a combination of an immediate injection of cash in the form of a pension obligation bond; we’d have to have a reduction in benefits negotiated with our unions; and we have to increase the town’s cash contribution.”

For this to work, SEGAL’s presentation offered three plans for reducing new benefits for current and future employees: a defined benefit plan, which locks in pensions at 1.5 percent per year, a defined contribution plan, similar to a 401(k) with returns that depend on market realities, or a hybrid plan, which is a mix of the two.

Current retirees’ benefits, according to SEGAL’s plan, will not be affected. What might be affected though, are pensioners’ cost-of-living adjustments.

All plans presented by SEGAL that resulted in solvency required some change from the current 3 percent that pensioners have been receiving for decades.

Michael Bellmore can be reached at 203-789-5282. Follow him on Twitter @bandango.

“The biggest message that we wanted to get out to retirees, and I think that we did today, was that no one is trying to take anything away from people.

“It’s just what percentage of increases moving forward can we all afford, to make sure you have a pension and that we can soundly, financially operate a town,” Leng said.

“So we’re going to be looking at everything from 1, 1.5, 2, 2.5 and probably the quarter ratios in between to find out where’s the sweet spot that you can live with and that we can live with.”

Robert Maturo, a retired police officer and president of Hamden Guardian Services Retirees Association, established to safeguard the pensions of retired police and firefighters, said he wasn’t surprised by the options presented by SEGAL. Doing nothing, he said, is an option long gone.

He said while any changes to current pensioners’ benefits are a point of contention, bonding and new benefit adjustments are a must. He was especially hopeful about a pension obligation bond forcing future councils to pay into the pension fund.

“We’re past the point of pointing fingers and blaming people,” Maturo said. “We need to work together. We need to get a plan that’s viable and that keeps the fund healthy for the next 50 years for all the town employees.”

Michael Bellmore can be reached at 203-789-5282. Follow him on Twitter @bandango.

SnowtoriousBIG 2013

Love that name for the storm - very funny.

In serious business, the Town has spent the last two days preparing for this storm on every front - ranging from Public Works, to Guardian Services, to Human Services and more. Communication efforts to get the latest and most comprehensive information on Town snow regulations and safety tips has gone well and the Mayor Declared a State of Emergency for the Town at 3:00 pm.

Hoping to get someone to help with snow this time - if it's a foot and a half I really don't want to break my back ...

We shall see.

Subscribe to:

Comments (Atom)