Phase In – The Facts

Someone once said, “Why let little ol’ facts get in the way of good political talking points”. This is what you experienced with recently with a 2nd Opinion Column by Ron Gambardella regarding the Reval Phase-In.

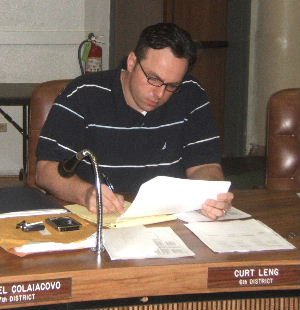

As many of you know, I have been a strong supporter of several progressive tax strategies aimed at lowering the tax burden on Hamden homeowners during this very difficult tax burden year. I worked hard with my fellow Councilmembers to lower the budget presented to us by the Town by some $6 million dollars +. During that process I was a vocal advocate of a 2-tier tax approach, one that would have lowered all of our residential mill rates by another mill and a half by keeping the motor vehicle tax at last year’s rate. This strategy would have helped so many Hamden homeowners and would have been good policy, assisting those who need the help most – especially seniors.

Unfortunately, this plan was not put to a vote because the Administration told the Council that the Town’s financial computer system could not handle the 2-tier tax rate. I argued that the Town should speed up their planned financial system upgrade in order to implement this plan, but we were told it would not be done.

The plan was not allowed, and because of this, along with a number of other reasons relating to taxes being too high for our residents to handle, I voted against the budget and the too high tax rate.

Last week, the Town Administration gave a presentation on the much discussed Revaluation Phase-In proposal. The concept, along with a few other progressive tax proposals, was discussed informally during the budget process and more recently by Mark Sanders, who gave an impressive presentation to the Legislative Council on the concept.

The Administration’s presentation demonstrated, unfortunately, that the type of Phase-In the Town can offer with its current financial system would need to be accomplished under a very specific statute, which leads to a more complex formula for Reval and less help to Hamden homeowners. The presentation showed, with hard numbers on homes ranging from $150,000 - $600,000 in value, the exact savings a person could expect, including the important vehicle tax cost, which does not “Phase-In” per State law. The Administration gave these numbers for both the 3-year and 4-year Phase-In concept.

To my great disappointment, the Phase-In did little to help our struggling taxpayers. The savings for any homeowner with a residential property under approximately $350,000 was about $100 after taking into account the change (increase) in motor vehicle tax that would also come from a Phase-In. As residents have seen recently from getting their tax bill, while their property tax has increased, motor vehicles have decreased, in some instances softening the blow.

With this not being an option that will do real justice in helping Hamden taxpayers, I asked the Administration to calculate what a 2-Year Phase-In would mean, what savings would result, etc., using the same legal formula. I still wanted to believe that we could help Hamden residents with some type of Phase-In legislation.

To my repeat disappointment, the savings were just a touch better – but again the average savings for any home under $350,000 was about $100. For all the promise of tax savings from a Reval, it would be a slap in the face to the taxpayers to give a savings of $80 and less to $300,000 and below.

The bottom line is that these Reval Phase-In proposals currently being discussed will not provide the real savings that we should be providing to help our tax burdened residents. If it were, I would initiate and vote for it in a heartbeat.

I’m not ready to give up on helping our residents following this flawed Revaluation. I want to continue to look at creative ways of reducing Hamden’s tax burden to help people as soon as possible.

But right now, the Reval Phase-In does not seem to be an option that will help our residents when we look at the facts.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment