Printed from www.patch.hamden.com

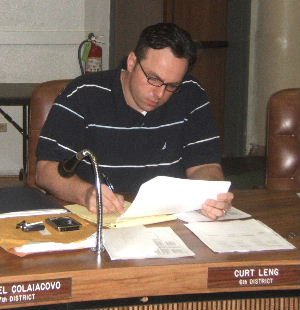

From Chief Administrative Officer Curt Balzano Leng:

The town's grand list, the total value of all taxable property and motor vehicles, has decreased, following the recently completed town-wide revaluation process. Revaluation of property values is required under state law every four years.

The grand list decreased from $4,310,212,858 to $4,022,853,966, a reduction of $287,358,892, or -6.67 percent. Overall, the revaluation produced a major change, seeing a reduction in the value of residential property and an increase for commercial property.

The following is an overview of the results:

Prior to the revaluation, the median residential single family residential dwelling assessment was $189,000; following the revaluation, that average assessment dropped to $171,600, a 10 percent reduction;

Prior to the revaluation, the median condominium assessment was $122,700; following the revaluation, the average dropped to $109,310, an 11 percent reduction;

Commercial property value increased by approximately 6.5 percent;

Motor vehicle values increased by approximately 3.6 percent.

(These totals and averages were supplied by Chief Assessor Jim Clynes)

“Completing the state-mandated revaluation on-time proved to be the right thing to do for Hamden residents. The results shift some of the tax burden off of residential properties, which were valued high during the last revaluation process due to the housing market bubble,” said Mayor Scott Jackson.

The town’s mill rate is currently 31.16. If the new grand list values were in place for last year’s budget, the mill rate to collect the same amount of taxes would have been 33.39 mills.

This calculation is given as a point of reference for people wondering how the new value of their home will be realized in their tax bill. The majority of residential properties saw a reduction in value.

To ensure that residents are fully aware of their property’s new value, new mill rate and how that change affected their tax bill, Mayor Jackson and Tax Collector Barbara Tito will issue tax bills with additional information in July.

The new information will include the 2010 assessed value, mill rate and total tax due, alongside the 2011 assessed value, mill rate and tax due. This will allow an accurate and transparent comparison of exactly what taxes each resident paid in 2010 and what will be owed in 2011.

- Posted using BlogPress from my iPhone

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment