Friday, August 02, 2013

Pension Reform a Hamden Priority - Fund Very Low

By Michael Bellmore

mbellmore@nhregister.com / Twitter:@bandango

HAMDEN — As the days tick down until Mayor Scott Jackson’s budget proposal, a bogeyman looms.

The town’s pension fund is at a crisis point. Currently, the pension fund is valued at $56 million. It should be $400 million.

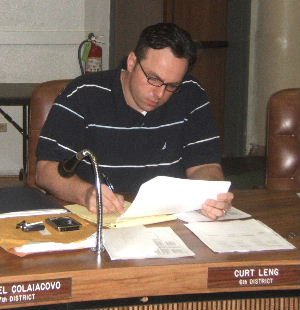

If the town did nothing, the fund would be bankrupt in five years, said Curt Leng, who is chief administrative officer.

Leng said the town is supposed to pay $28 million into the fund next year. Doing so would require a four mill tax increase. Property owners with a house assessed at $200,000 would pay an additional $800 in taxes next year.

Paying as you go annually would lead to tax hikes for the next 30 years, Leng said.

Not ideal. So town officials hired The Segal Co., a benefits and human resources consulting company in New York, to develop strategies to address the pension woes.

Segal’s plan would still require a four mill increase, but it would be spread over six years. Taxpayers with a $200,000 assessment would pay an additional $150 in taxes annually.

Segal presented 15 proposals aimed at addressing the problem. However, only a few would solve the problem within 30 years.

The town must accept a cash infusion and reduce the benefits of current municipal employees, according to Segal’s proposal. All options center on the town receiving a $115 million pension obligation bond from the state. This POB will immediately bolster the pension fund.

A lot more is needed, including reducing the cost of living increase employees and retirees receive, and exploring the concept of a 401(k) contribution or defined benefit plan.

The pension crisis is a result of five past administrations’ failure to pay into the fund the proper amount, Leng said.

“The town as far back as we can look, and with certainty to the last two decades, has never put in the actuarial required contribution,” Leng said.

Segal in a report said the town has not contributed more than 72 percent of the required annual contributions for any year since 1995.

In 2000 and 2001, no pension contributions were made when $12 million was required. From 2002-2004, less than 10 percent of the required contributions were made.

The average contribution from 1995-2010 was only about 38 percent of what was needed.

A long-time Town Council member said no contributions were made in 2000 and 2001 because the fund was at 70 percent and the stock market was strong, but later bottomed out.

Robert Maturo, a retired police officer and president of Hamden Guardian Services Retirees Association, which was established to safeguard retired police and firefighters pensions, said a POB is a good thing. He said the POB will force future administrations into making the required annual contribution.

While town officials and employees agree a POB is integral to shoring up the fund, Segal’s report stated reducing benefits is also necessary.

Segal suggested the town consider adopting a defined benefit plan. Leng said this plan guarantees the amount of money an employee will retire with after a certain number of years.

The defined benefit plan places the investment risk on the town.

This plan would lower current and future defined benefit accruals of employees’ pensions to 1.5 percent of their income per year. It would also affect the cost of living adjustment, or COLA, of current and retired employees.

Variations of the defined benefit plan were proposed, but only two resulted in solvency. One removed COLA for future and current retirees, and one reduced COLA to 1 percent per year from 3 percent for future and current retirees.

The zero percent COLA plan results in a fully funded pension after 2030, with 1 percent COLA reaching 100 percent funding after 2040.

Segal proposed the town create a 401(k) plan in which the town matches an employee’s contribution of up to 6 percent of their income per year.

This plan is possibly more lucrative for employees, but the amount accrued depends on the markets, placing more risk on workers. If the town adopted a 401(k) plan and reduced the COLA contribution, the pension fund would be in better shape quicker.

SEGAL’s final proposal included a hybrid plan. The town would guarantee to fund 1 percent of an employee’s salary into the pension, while also matching up to 3 percent of their salary in a 401(k) plan. This plan spreads risk evenly among town and employee.

For the pension fund to reach solvency, the COLA must be reduced to at least 1 percent for current and future retirees. The hybrid plan takes more time to reach solvency by a few more years.

But for any of this to work, the unions must accept benefit cuts.

While any benefits accrued up until now would remain unchanged, Segal’s proposal ruffled feathers.

Police Union President Michael Ambrosino said he knows the town must do something to fix the problem, but it was created by past administrations.

“You don’t know what the town really wants to do until the town tells you what they would like,” Ambrosino said. “We’re open to listen, but I don’t know if anybody would drastically change the contract they already have for something that’s really no fault of ours.”

Michael Bellmore can be reached at 203-789-5282.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment