Friday, September 27, 2013

Jackson for Hamden

Proud to be working on the Jackson for Hamden Committee to Re-Elect Mayor Scott Jackson. I am serving in this year's campaign as the Political and Operations Director.

Thursday, September 26, 2013

Pension Bond Part of Comprehensive Pension Reform - Will Bring Pension Fund from 14% Funded to Over 40+% Funded in 2014

(From the NH Register)By Michael Bellmore

HAMDEN >> The Legislative Council this week approved what could be the single most important step in fixing the town's crippled pension fund.

After a study by the Segal Co., a benefits-consulting firm, the council approved a $125 million pension obligation bond.

This injection of cash will bring the fund from 14 percent funded to 40 percent funded, from about $50 million to $175 million.

Judi Kozak, council president, said approving the bond was the lesser of two evils.

"It's not a magic wand," Kozak said. "It just allows us to put the past behind us and move forward."

The bond was passed 14-1.

(Blogger's Note: this action, in conjunction with Mayor's reduction of current retiree cost of living increase from 3% to 1.59% this year, improved annual pension funding in FY14 budget and the negotiation of contracts with majority of Town bargaining units that has new hires starting in 2017 going from pension plan to a 401K style program are pieces of the Comprehensive Pension Reform Plan produced by Mayor Jackson and his team of nation-wide experts assembled to address this problem.)

Republican Austin Cesare agreed that now was the time to act.

But, he said, this solution is the result of gaffes by past councils and administrations. He said every year the town has bills to pay, but, for whatever reason, the actuarially recommended amount that should have been paid into the pension fund hadn't been paid in full for years.

"Past councils and past mayors have pretty much played games with the pension contribution," Cesare said.

"They would not contribute what the actuaries recommended, so as a result we are left now with having to fund the pension fund with no other alternative but bonding."

Kozak made it clear that a healthy pension fund is not just beneficial to pensioners, but to the entire town. She said it's "not just the movies and the TV sets that have to worry about ratings."

"I do worry about our rating agencies," Kozak said.

"If people don't understand how important they are, without good ratings you can't get roads paved, sidewalks done, grants for our projects ... Without a good credit rating you're not a healthy town," Kozak said.

And with a broken pension fund, those credit ratings are at risk.

"If we contribute a sum of money we could finally have our heads above water," Kozak said.

"(Otherwise) our credit rating will go down and so will everything we touch. It's too big a sum of money to think we could get out of this without some kind of help."

Kozak said this pension obligation bond finally gives the town a grasp on the situation. It also will force the town's hand to continue adding to the fund to keep it healthy.

"This step has made it that we can't fall behind again," Kozak said. "We have to put the money every year in the pension. Pay as you go was really not an option."

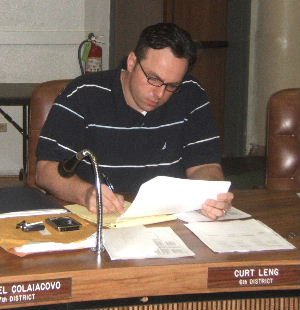

Chief Administrative Officer Curt Leng said that if nothing had been done to fix the fund, it would have been bankrupt in a matter of years. If that had happened, citizens would have faced a huge tax hike, with significant increases every year to meet the increase in pension costs.

Leng said the POB, in addition to previous steps taken to manage the crisis, such as lowering the cost-of-living adjustments given to pensioners every year from a de facto 3 percent to a contractual rate matching the Consumer Price Index, will give the pension fund a chance to heal.

Cesare said the bond is obviously a lot of money to be borrowed.

"The risk," Cesare said, "is a stock market downturn, but how do you know when that's going to happen, how is it going happen? You really don't."

Leng said the town plans on investing the bond carefully over one to two quarters. In order to ensure those investments won't be risky, he said the plan is to invest with 7 percent expected returns, and balance that against the 6 percent interest rate of the bond.

The plan, he said, is to be as conservative with the money as possible.

He also added that while Hamden's pension fund is a fraction of what it should be, the investment and return of that money has a higher performance than 88 percent of pension funds in the nation.

The only problem is that the return on $50 million is negligible when the town has to pay out $1.9 million to pensioners every month. But, with another $125 million in the pot, the hope is, if the town follows the Segal plan, the fund will be able fix itself over time.

Hamden Pension Fund Informational Meeting

(Article from NH Register)

By Phyllis Swebilius

HAMDEN >> An informational meeting on the town's underfunded pension fund Wednesday night drew more than 100 people to Miller Memorial Library, including several in uniform.

"The time's come to act," Mayor Scott Jackson told the Legislative Council. The fund is underfunded by $350 million and contains only 14 percent of what is necessary.

Town bond counsel David M. Panico echoed the mayor's comment.

"There is no more time for delay," he told the council, thogh a decision was not to be made Wednesday night.

Details of the plan will be posted on the town's website today.

Jackson said the Segal Co., hired to advise the town on its choices, is "comfortable dealing with billions, not millions" of dollars.

"This is a 30-year plan," Jackson said.

"What I asked for is a plan that will outlive me," he said. "The council will look at the components of the plan and modify it as they see fit.

"One way or another the town of Hamden is getting out of this," he said.

Chief Administrative Officer Curt Leng said the town's bond counsel has said the most inexpensive, viable option is:

o Changing the cost of living adjustment, which this year went from 3 percent to 1.59 percent.

o Putting more money into the fund. The town this year increased the contribution from $9.3 million to $12.5 million, the largest one-year increase to date.

o Selling pension obligation bonds. Jackson told the council, "A (pension obligation bond) is a potential part of the solution that is in your hands."

However, the bond is "not a magic wand," said town financial adviser Barry J. Bernabe.

The issue is "black and white," Eric J. Atwater, Segal Co. vice president, said. There are about 500 people in the pension plan, mostly retirees, he said. Inaction now would deplete the fund in five years, according to Atwater.

Residents, employees and retirees expressed their own ideas before the advisers spoke. Some were concerned about putting the town into debt and the potential effects on their property values and taxes.

"Borrowing is risky," George Levinson said.

Of the pension obligation bonding, Anne Sommer said, "I think timing is the key and there are a lot of risks involved.

"The experts don't have a crystal ball. Nobody does," Sommer said. "This is a very, very serious decision."

Bob Anthony, a Fire Department retiree, asked the council "to bond at the right time."

Another resident said the unions have to make concessions. Town workers' pay is better than private employees and the benefits are "extraordinary," he said.

Some warned a decision should not be made quickly.

"Are we making a decision when we don't have enough information before us?" asked Michael Montgomery.

Retired Police Chief John P. Ambrogio pointed out the problem goes back to the 1970s. He told the council, "You can't blame the unions."

"The retirees that put in 20, 30, 40 years to the town of Hamden should feel comfortable that they're going to get the check once a month," said retired Police Chief Robert Nolan.

The issue has been "kicked down the street for some time," United Public Service Employees Union representative Wayne Gilbert said.

Sometimes the town put no money into the fund, he said.

"The pension fund is a written contract ... a written promise," he said. Public employees do not earn more than the private sector, he said. "Yes, they get more sick days."

At least three sets of concessions have been made by the unions, he said.

"Real money was given back to this town by the employees," Gilbert said. "If you do nothing, we all go down."

Joseph Cirillo, representing Town Hall workers with Local 2863 AFSCME, said the union has consistently contributed to the pension fund while concessions have been made in 10 years. "We've given up a lot."

The union has a contract coming up. "We're nervous and concerned about the future," Cirillo said.

Subscribe to:

Comments (Atom)