Thursday, September 26, 2013

Hamden Pension Fund Informational Meeting

(Article from NH Register)

By Phyllis Swebilius

HAMDEN >> An informational meeting on the town's underfunded pension fund Wednesday night drew more than 100 people to Miller Memorial Library, including several in uniform.

"The time's come to act," Mayor Scott Jackson told the Legislative Council. The fund is underfunded by $350 million and contains only 14 percent of what is necessary.

Town bond counsel David M. Panico echoed the mayor's comment.

"There is no more time for delay," he told the council, thogh a decision was not to be made Wednesday night.

Details of the plan will be posted on the town's website today.

Jackson said the Segal Co., hired to advise the town on its choices, is "comfortable dealing with billions, not millions" of dollars.

"This is a 30-year plan," Jackson said.

"What I asked for is a plan that will outlive me," he said. "The council will look at the components of the plan and modify it as they see fit.

"One way or another the town of Hamden is getting out of this," he said.

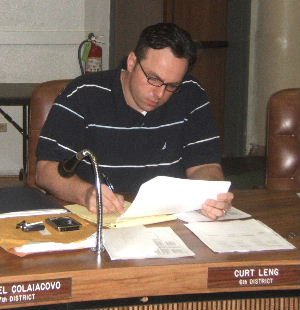

Chief Administrative Officer Curt Leng said the town's bond counsel has said the most inexpensive, viable option is:

o Changing the cost of living adjustment, which this year went from 3 percent to 1.59 percent.

o Putting more money into the fund. The town this year increased the contribution from $9.3 million to $12.5 million, the largest one-year increase to date.

o Selling pension obligation bonds. Jackson told the council, "A (pension obligation bond) is a potential part of the solution that is in your hands."

However, the bond is "not a magic wand," said town financial adviser Barry J. Bernabe.

The issue is "black and white," Eric J. Atwater, Segal Co. vice president, said. There are about 500 people in the pension plan, mostly retirees, he said. Inaction now would deplete the fund in five years, according to Atwater.

Residents, employees and retirees expressed their own ideas before the advisers spoke. Some were concerned about putting the town into debt and the potential effects on their property values and taxes.

"Borrowing is risky," George Levinson said.

Of the pension obligation bonding, Anne Sommer said, "I think timing is the key and there are a lot of risks involved.

"The experts don't have a crystal ball. Nobody does," Sommer said. "This is a very, very serious decision."

Bob Anthony, a Fire Department retiree, asked the council "to bond at the right time."

Another resident said the unions have to make concessions. Town workers' pay is better than private employees and the benefits are "extraordinary," he said.

Some warned a decision should not be made quickly.

"Are we making a decision when we don't have enough information before us?" asked Michael Montgomery.

Retired Police Chief John P. Ambrogio pointed out the problem goes back to the 1970s. He told the council, "You can't blame the unions."

"The retirees that put in 20, 30, 40 years to the town of Hamden should feel comfortable that they're going to get the check once a month," said retired Police Chief Robert Nolan.

The issue has been "kicked down the street for some time," United Public Service Employees Union representative Wayne Gilbert said.

Sometimes the town put no money into the fund, he said.

"The pension fund is a written contract ... a written promise," he said. Public employees do not earn more than the private sector, he said. "Yes, they get more sick days."

At least three sets of concessions have been made by the unions, he said.

"Real money was given back to this town by the employees," Gilbert said. "If you do nothing, we all go down."

Joseph Cirillo, representing Town Hall workers with Local 2863 AFSCME, said the union has consistently contributed to the pension fund while concessions have been made in 10 years. "We've given up a lot."

The union has a contract coming up. "We're nervous and concerned about the future," Cirillo said.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment